We all know the problem of handling multiple cards. And, the worst thing is to have a constant worry about paying bills on time. Here, the CRED Business Model plays an important role. All the tasks of paying bills from credit cards such as home rent, and raising a loan can be done in a single CRED application. So easy right?

Day by day, we are observing changes in our lifestyle, from shopping online to booking cabs from our door. In this list, CRED has become a game-changer. The basic purpose of the CRED business model is to provide rewards, discounts and tracking expenses for paying bills timely. Therefore, forget all your worries about transactions. Now, let’s dive into the CRED case study.

Table of Contents

What is CRED?

CRED is an Indian startup that has over a valuation of 40,000 crores in four years. It has become a pioneer in monetising credit card timely payments. It was started back in April 2018 by Kunal Shah. Its headquarter is in Bengaluru. Further, it serves users to eradicate the burden of carrying several credit cards. In simpler words, CRED is a way to minimize the burden of handling multiple credit cards and make credit card payments easy and convenient. Besides, the smoothness of the application makes it stand out from any other platform.

Going back to 2015, when Kunal Shah sold Freecharge. He thought of such ideas that can work on people’s behaviour and can make a change. So, through his studies, he got to know developed countries have introduced many automatic products. For instance, no cashiers at malls and supermarkets and no attendants at gas stations etc. But he found one inefficient thing: There is no such product that would allow people to pay bills before the deadline with no extra charge. From here, the story begins with the CRED business model.

To attract users to the CRED platform, he decided to provide rewards and incentives to its loyal credit card customers. Because in his study he finds that when people get rewarded in return for doing something it makes them complete the task on time and improve personal finances. And, with such an idea, in 2018 CRED was introduced.

CRED Funding Partners

CRED funding partners include Falcon Edge Capital, and Tiger Global (both invested 251 Million USD). London-based Marshall Wace, Steadfast Venture Capital, Sofina, DST Global, Coatue Management, LLP, Insight, RTP, Dragoneer and more.

What is the CRED Business Model? Know how it works

CRED provides all reasons for people to pay their bills through its application. After all, there are so many offers and rewards available for customers. But, from where are so many offers coming? Basically, CRED partners with businesses and those businesses are the ones where users are spending their money. Consequently, businesses offer displays on the CRED app to drive customers.

The business model is entirely based on three pillars:

-

Rewarding users for paying credit card bills

The function of paying bills through any other app or by the CRED app is similar. However, the difference is that customers get benefits by paying credit card bills through it. As a result, customers are happily using and appreciating the CRED business model more.

-

Customers earn CRED coins to win exciting rewards

Customers who mostly pay through this app can collect CRED coins and redeem them for rewards. While using the app, customers can see all the offers on paying credit card bills.

-

CRED join hands with businesses to help in providing offers

CRED partners with businesses are important because through this users can see more and more offers on the app. Moreover, the app doesn’t differentiate in the visibility of small or large businesses. Because all kinds of users or buyers use the CRED.

Who are the Users of CRED?

In the starting days, the CRED targeted wealthy audiences and gave its community the name ‘CRED Club‘. And, today CRED has over 75 lakh users. Presently, if you have over 750 credit scores then you can operate CRED facilities. If users are under 750 credit scores, they will be sent to a waitlist.

Further, once the users get access to the app, CRED can read all the mails statements, scan the credit card receipts, bank balances and more. It examines all the expenses and records loan caps. Most importantly, it advises its customers to avoid extra charges.

Have you ever thought why Alia Bhatt, Virat Kohli and Kiara Advani are not seen in ads for CRED? But Anil Kapoor, Madhuri Dixit, and Rahul Dravid are advertising it? Because its ads and programs mainly focus on the Y Generation only. It aims to capture and attract Generation Y (people of age 25 to 40).

How CRED earn?

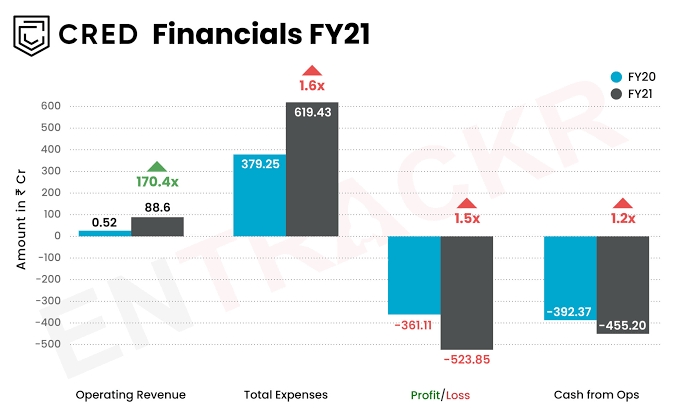

After understanding its business model, let’s see how CRED earns or makes money. It is important to know because, in 2021, the company faced a loss of 524 crores. So, the question is what are other sources through which revenue is coming.

-

CRED Coins

We have mentioned above that users get coins after every payment. And, with those coins, users can redeem their rewards such as discounts, offers, cashback etc. How does this help in CRED earning? When a customer redeems those coins to get a reward, every time CRED receives revenue.

-

Advertisement

The next source is advertisement! Many brands or companies’ products/ services are advertised on CRED applications. And for these advertisements, it demands a fee. That’s how CRED earns.

-

CRED Loans

Giving loans has also been added to the CRED business model. It is in collaboration with IDFC banks. In just a few easy steps, customers can get a loan of up to 5 lakhs. As a result, it earns through commission.

-

Data

No app works without collecting data! So, CRED collects your financial data and uses it for providing better results. Moreover, they can easily find trustworthy CRED users through their financial records.

-

CRED Pay and CRED Rentpay

As the application was launched in collaboration with Razorpay and Visa. It allows instant payment through the D2C channel. On the other hand, CRED provides the option for paying the house rent. For this, it charges a transaction fee of 1-1.5% (depending on users’ credit card network). Furthermore, users will get interest-free credit periods and rewards.

-

CRED store

Access to the CRED store is only to its qualified users. They can buy amazing products and win rewards through the store by using their CRED coins. The coins will be earned whenever customers made payment.

‘Zero Revenue startup’, still investors investing in CRED Business Model?

We know, now all would be thinking about why investors are ready to invest in this zero revenue startup? Even the CRED case study shows the company is in huge losses. Its revenue is coming from minor sources which are quite less than its losses.

The only reason is that CRED is focusing on long-term plans. It is noticeable as it is making convenient transactions and providing the best services to users while being in loss itself. Then obviously it have its own reaons. But again the question arises, how is the CRED able to do all this?

- Significant Customers Data

Currently, there are lakhs of users on CRED. Obviously, it has all their financial data. To earn a massive profit, it can share this data with big companies. Consequently, companies will analyse the customer’s financial behaviour and target accordingly.

- Financial Services

CRED has already partnered with IDFC banks to provide loans to their customers. Moreover, it is planning to collaborate with more banks to provide other financial services. And who knows it will have its own credit cards in future!

- Expansion

The CRED is working smart and does its analyses of the country’s people really well. According to the data, the amount of credit card holders is too low in India as compared to other countries. In India, every 20 people have 1 credit card. Whereas, in the US every 1 person has 4 credit cards. What a huge difference! As a result, the company can expand the business to other countries to earn more revenue.

Bottom Line

CRED is a fintech company established in 2018 to change the perspective toward credit cards and financial services. Currently, CRED doesn’t charge any fee to use it. Isn’t it great? You don’t need any kind of membership to make your burdensome transactions easy. With its outstanding marketing strategy, the company is drawing the attention of many people around the world.

Furthermore, the CRED case study indicates it is concentrating on long-term goals that’s why several big investors are investing in it unhesitantly. However, time will tell whether this CRED business model sustains or makes further changes in people’s mindsets or not.