Nowadays, parents go to education loan options for children’s higher studies. However, choosing the most appropriate one is quite challenging. For students, September has been observed as a big month this year. After constant tug-of-war between students and the Central Government, finally, lakhs of students appeared for national level JEE and NEET exams.

It’s also that time of the year when overseas-bound pupils pack their bags to head for their chosen destination country for their respective higher studies.

While private and foreign banks compete hard for slices of businesses in other loan segments, especially credit cards, public sector banks rule the roost in the education loan sector.

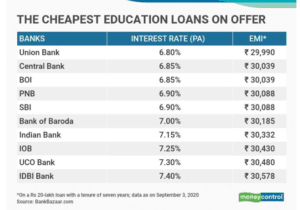

At 6.80 percent for a Rs 20-lakh study loan with a term of seven years, PSU major Union Bank of India offers the lowest rate presently.

After this, comes the Central Bank of India and Bank of India in the table of the prime ten banks by the cheapest rates charged. Both charge an interest rate of 6.85 percent. State Bank of India and Punjab National Bank cite a slightly higher rate of 6.90 percent.

There is not a single private or foreign bank figures in the top-10 list. South Indian Bank, which offers the lowest interest rate (7.65 percent) amongst private sector banks, is 11th on the list of lenders proposing the economic education loan rates.

Table of Contents

Table- Summarising Data

Interest rate and costs on education loan for all listed (BSE) public and private banks are considered for data collection; Banks for which data is not accessible on their website, are not considered. Data is collected from the respective bank’s website as of September 3, 2020. Banks are listed in clambering order on the basis of interest rate, i.e., the bank proposing the lowest interest rate on education loan (Loan amount up to Rs 20 lakh) is placed at the ceiling and highest at the floor.

EDUCATION LOAN: OPTIONS TO EASE STUDENTS’ STRESS

The lowest rate given by the banks on a loan of up to Rs 20 lakh is contemplated in the table. EMI is estimated on the basis of the Interest rate cited in the table for Rs 20 lakh-loan with a term of seven years (processing and other charges are determined to be zero for EMI calculation); GST is eliminated.